Thinking about a Hybrid Strata Loan?

Think again!

In strata, safe hands matter. They shape your community and the future of your investment. You need a funding solution that works simply and fairly for all stakeholders, while supporting the ongoing maintenance and necessary capital works – not one that adds admin, tax and sales headaches.

Lannock’s fuss-free and proven approach is just one of the reasons why we don’t offer ‘hybrid strata loans’. These ‘new to market’ loans may look clever on paper, but the additional risks often don’t add up for the people who matter the most: owners.

Talk to Australia's leader in strata finance

Speak with our strata finance experts today.

Call 1300 851 585

What is a hybrid strata loan?

A hybrid strata loan lets some owners lend to their strata corporation while the corporation borrows the balance from an external lender. Both loans are unsecured.

Marketed as ‘self funding’ and pitched as a way to reduce interest costs, a hybrid strata loan may sound appealing, but it’s just clever marketing – these are not the genuine savings promoted and lending owners are faced with additional tax and administration fees. Potential apartment buyers will be wary of the complex arrangements and all other owners face additional cost and complexity. Nobody really wins.

Consider these downsides for stakeholders

Interest savings and ‘flexibility’ sound attractive, but the reality is that the additional admin, complexity and risk fail to deliver benefits and value across the strata community:

Hybrid-lending owners will likely find that after-tax returns are lower than a basic term deposit, and that capital could be better invested elsewhere. Promised interest savings will evaporate once taxes and extra admin fees are added back. And ‘internal’ loans (that is, owner to owner corporation) are confusing for purchasers, further complicating resale values and bank valuations.

Ordinary owners will face higher costs for strata management when fees for complex administration and extra tax returns are factored in.

The strata corporation will now face more complex administration and reporting, along with baked-in risks – tax miscalculation, purchaser uncertainty, hits to valuations and neighbour-to-neighbour disputes - should anything go wrong.

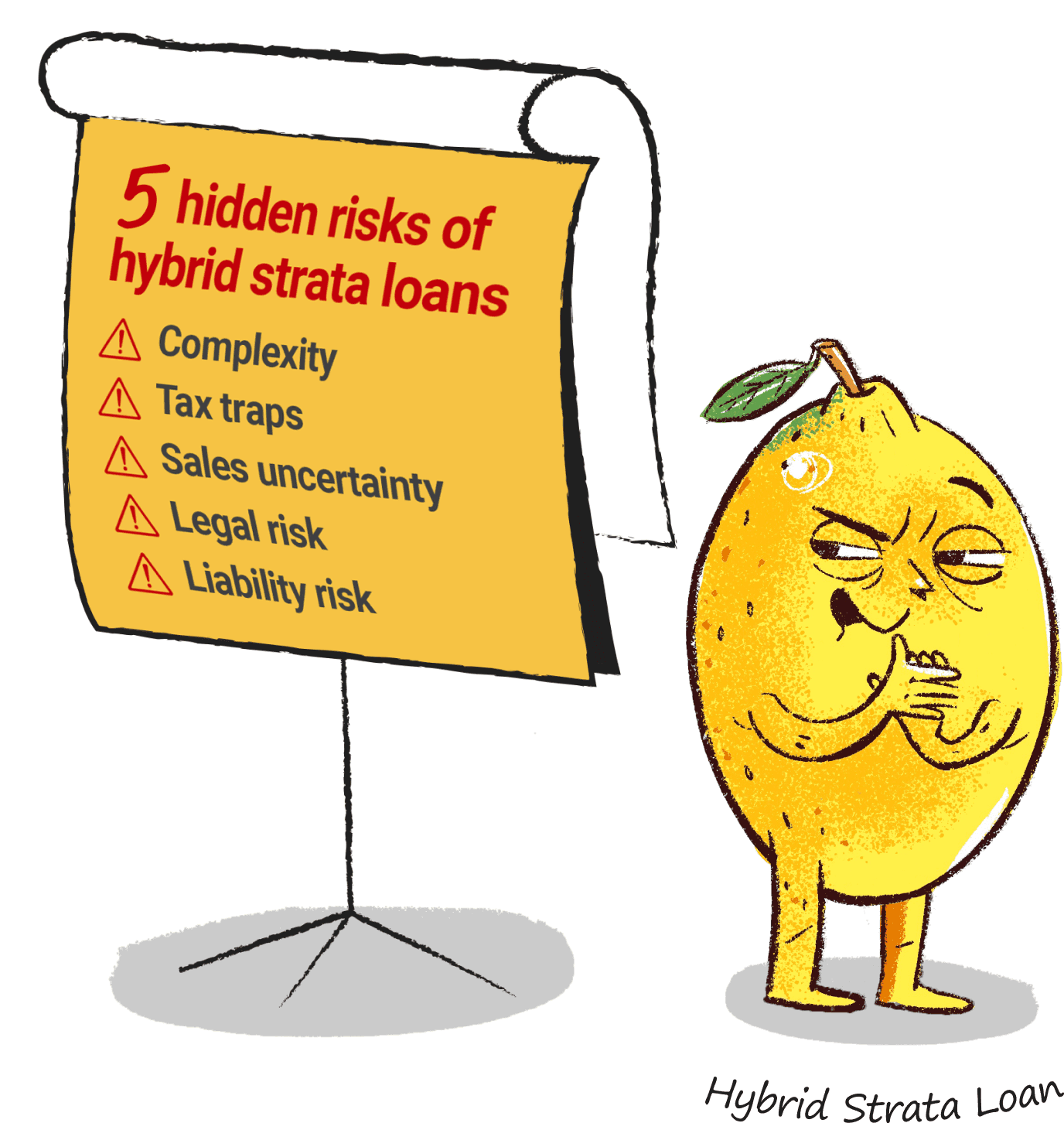

5 areas of risk with hybrid strata loans

Complex management and reporting

Routine reporting becomes manual and will escalate to cover:

Multiple lenders to the corporation

Multiple accounts to hold the lending owners’ contributions

Pro-rata levy splits

Individual Annual Investment Income Returns on assessable income for submission to the ATO

That complexity drives up admin hours for the corporation and increases levies for every owner, not just the lending owners. More manual data inputs increase the risk of costly reporting errors.

Tax Traps

Too many owners only find out about the tax traps when their accountant calls. By then it's too late.

As a lending owner, you will:

Be taxed on money you never see – the ‘interest credits’ allocated to you are treated as assessable income by the ATO, even though no cash lands in your bank account

Lose valuable deductions – unlike a standard strata loan where the levy to service the loan is 100% deductible, investors who become lending owners miss out on these tax benefits.

Sale uncertainty that undermines value

A hybrid strata loan is anything but simple! At the very moment you want a simple, straightforward sale, you’re left juggling extra contracts, complexity and uncertainty and dealing with a purchaser who likely knows nothing at all about this.

As a lending owner, this added complexity raises tough questions:

How will lenders and conveyancers view your unsecured internal loan?

Will buyers consider a property with a complex internal loan they do not understand?

Do you want to be tied to an illiquid investment for the life of the loan?

Beware the fine print

Take a look at the lending owner contract – there’s not much fine print for what is a very complex financial product and that’s a problem. Properly documenting loans like this is complex – simple contracts do not reflect what is required. No fine print doesn’t mean less risk, it means:

Fewer safeguards

No clear dispute framework

Less clarity

When important detail is missing in financial contracts, surprises are expensive.

You’re still on the hook

You think you’ve ‘paid your share upfront’? Think again. You have not ‘paid upfront’, you are a lender to a corporation of which you are a member and are still on the hook for:

Repaying the external lender

Budget blowouts

Future shortfalls

Penalties – fees and interest

As a lending owner, you haven’t reduced your exposure, you’ve increased it. You now have the lenders risk, as well as the usual strata owner borrower’s risk (through your unlimited joint and several liability to the owner corporation).

Hybrid strata loans might look attractive – but the risks are real. Read the detail, get independent advice and understand who is really on the hook and what you are on the hook for, before you sign.

Lannock strata funding ticks all the boxes

Service

Quality

Fund stability

At Lannock, we’ve been helping strata communities for more than 20 years. Through our experience, we know that finance solutions designed with flexibility, transparency, and value in mind help strata communities move ahead with confidence and clarity.

If you’re thinking about a hybrid strata loan, talk to Lannock first to find out how a conventional and simpler funding solution could meet your needs without the hidden risks and traps. We can arrange a no-obligation information session for your Strata Corporation.

With Lannock, you can enjoy:

One contract, one payment schedule, one interest rate

Full tax deductibility for investors – capital and interest payments

Predictable cash flow and professional management if strata levy arrears arise, removing personal conflict

Straightforward disclosure to buyers and valuers